iReach Insights Press Release

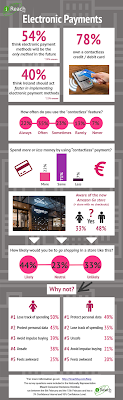

- 54% of people in Ireland think electronic payment methods will be the only payment method in the future.

- 22% say they spend more money by using the “contactless” payment method.

- 40% think that Ireland should act faster in implementing electronic payment methods.

- 44% of people in Ireland say would go shopping in a store with no checkouts, like the new Amazon Go store.

Contactless payment systems are a popular method of payment that is used in most shops nowadays. Methods of payments are changing, with more people shopping online and paying via apps such as Just Eat and MyTaxi people are using their bank cards more frequently. Although paying by cash is anonymous, paying by card is convenient, secure and quick. With the opening of the Amazon Go store in Seattle in January, Amazon has made the next step in electronic payment methods. Instead of paying by card or handing over cash, customers scan their Amazon Go App on their phone when they walk into the store, grab whatever they want and leave. Their account is automatically charged when they walk out. Even though it opened in the US and there is no store like it in Ireland, 33% of women and 48% of men in Ireland are aware of this store. 44% would go shopping in a store like this, 23% are unsure and 33% state it is unlikely for them to shop in a store like this. Some people go as far to say that cash won’t exist for much longer and when you take Sweden as an example, nearly half of all banks don’t accept cash anymore. It is no surprise that most people in Ireland (54%) think that electronic payment methods will be the only method of payment in the future.

Contactless payment systems are a popular method of payment that is used in most shops nowadays. Methods of payments are changing, with more people shopping online and paying via apps such as Just Eat and MyTaxi people are using their bank cards more frequently. Although paying by cash is anonymous, paying by card is convenient, secure and quick. With the opening of the Amazon Go store in Seattle in January, Amazon has made the next step in electronic payment methods. Instead of paying by card or handing over cash, customers scan their Amazon Go App on their phone when they walk into the store, grab whatever they want and leave. Their account is automatically charged when they walk out. Even though it opened in the US and there is no store like it in Ireland, 33% of women and 48% of men in Ireland are aware of this store. 44% would go shopping in a store like this, 23% are unsure and 33% state it is unlikely for them to shop in a store like this. Some people go as far to say that cash won’t exist for much longer and when you take Sweden as an example, nearly half of all banks don’t accept cash anymore. It is no surprise that most people in Ireland (54%) think that electronic payment methods will be the only method of payment in the future.

iReach Insights conducted nationally representative survey and 1,000 adults were asked about their opinion about electronic payment methods, especially contactless payment and their concerns surrounding these. Interestingly, not only do more than the half (54%) of people in Ireland think electronic payment methods will be the only one in the future, 40% share the opinion that Ireland should act faster in implementing electronic payment methods.

Also, the majority of people in Ireland (78%) own a contactless credit / debit card. 57% of them use the contactless feature very often, 23% sometimes, 13% rarely and only 7% use never the contactless feature. The frequency of usage differs with the different ages of those involved. The younger age group uses the contactless feature a lot more than the older age cohort.

The people who would rather not go shopping in a store like this were asked about their concerns and here are the TOP 5 concerns: 1. Protect personal data (46%), 2. Lose track of spending (44%), 3. Unsafe (36%), 4. Avoid impulse buying (31%) and 5. Feels awkward (23%).

When about it comes to technology, people are always concerned about their personal data, hackers and privacy breaches. Especially when it comes up to money, people’s fears are amplified. As the advances in technology can’t be stopped, it is becoming increasingly important for people to implement measures to protect themselves or avoid the new features altogether.

For more information on these research findings please feel free to call iReach on 01-2143740 or email to oisin.byrne@ireachhq.com

What about you? Share and comment!

SIGN UP, TAKE PART in our surveys for free and GET REWARDED! iReach Conversations

No comments:

Post a Comment